Financials

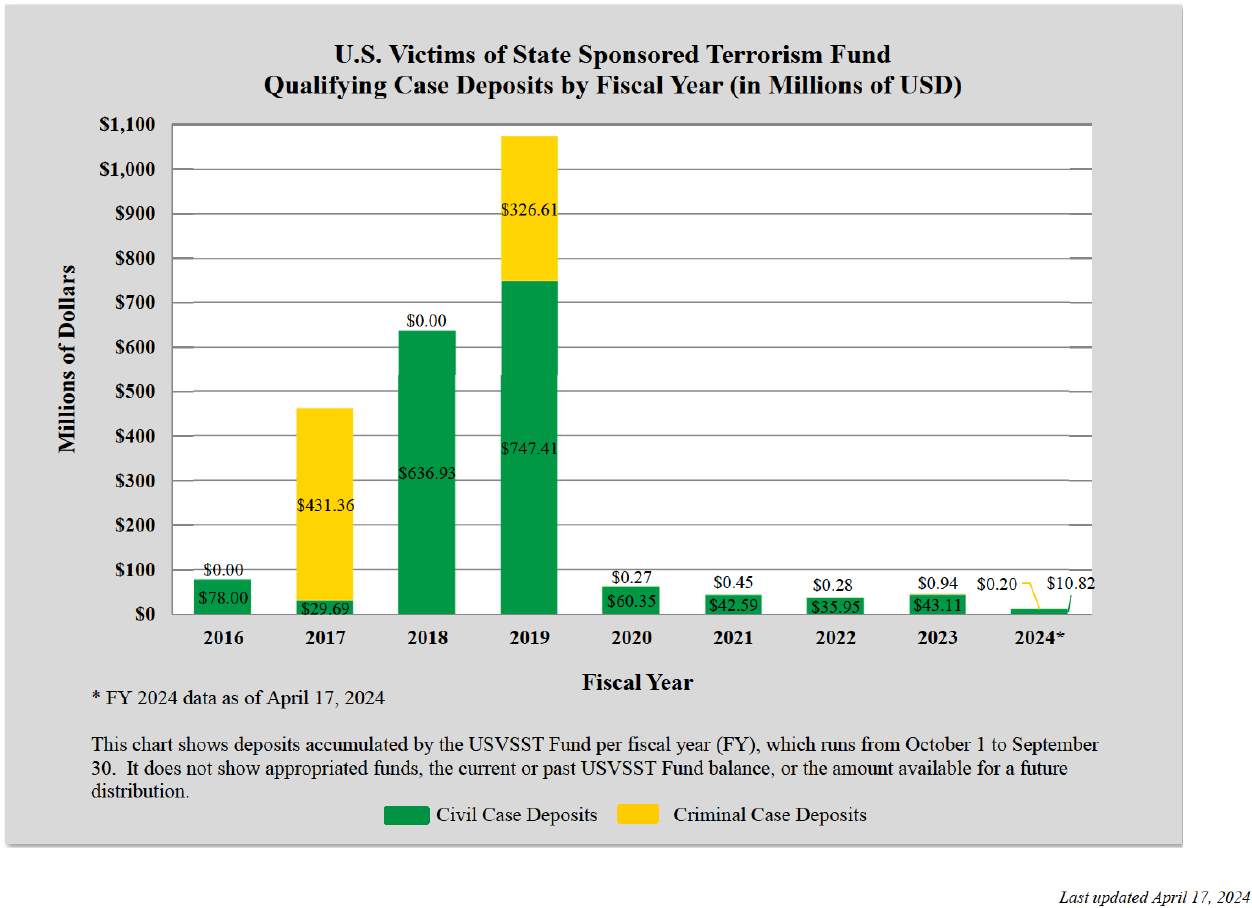

The USVSST Fund continuously accumulates deposits from qualifying cases. This chart provides information about the qualifying case deposits accumulated by the USVSST Fund:

Listed below are cases or matters with publicly available information where some or all of the proceeds qualified for deposit into the USVSST Fund. Note that for matters with deposits in multiple fiscal years, the matter is listed in only the first fiscal year with a deposit. The USVSST Fund updates this list periodically, as additional funds are deposited into the USVSST Fund. The USVSST Fund will identify the total amount of funds available for payments closer to the time of the next round of distributions.

For additional information about qualifying case deposits and how the USVSST Fund’s general distributions are funded, please review the information in Section 9 (Qualifying Cases) of the USVSST Fund’s Frequently Asked Questions.